Rebuilding credit can feel overwhelming, especially if you have a low credit score or past financial mistakes. Many traditional credit cards reject applicants with bad credit, leaving limited options. This is where a secured credit card for bad credit with instant approval becomes a practical and realistic solution.

Secured credit cards are specifically designed for people who want to rebuild credit safely. They offer easier approval requirements, faster decisions, and a clear path toward better credit health when used responsibly. This guide explains how instant approval works, who qualifies, and how secured cards can help improve your credit over time.

Secured Credit Card for Bad Credit With Instant Approval: How It Works

A secured credit card is a type of credit card that requires a refundable cash deposit. This deposit acts as collateral and usually becomes your credit limit.

For example, if you deposit $300, your credit limit is typically $300. Because the bank already has your deposit, the risk is lower, which is why secured cards are widely available to people with bad credit or no credit history.

A secured credit card for bad credit with instant approval is ideal for people who want fast access to credit while rebuilding their financial profile responsibly.

How Secured Credit Cards Work

- You submit an application online

- You provide a refundable security deposit

- The card issuer reports your activity to major credit bureaus

- Responsible use helps build or rebuild credit

Unlike prepaid cards, secured credit cards do report to Experian, Equifax, and TransUnion, making them a legitimate credit-building tool.secured credit card for bad credit with instant approval

What Does “Instant Approval” Really Mean?

When people search for “instant approval,” they often expect immediate access to a credit card. In reality, instant approval means an instant decision, not instant card delivery.

Instant Decision vs. Same-Day Approval

- Instant decision: You receive approval or denial within minutes

- Same-day approval: Your application is approved the same day, but card delivery takes time

- Card delivery: Usually 7–14 business days

Many secured cards offer automated approval systems, allowing applicants to get a decision almost immediately after submitting their information and deposit.

Can You Get Approved With Bad Credit?

Yes. Secured credit cards are among the most accessible options for people with:

- Low credit scores

- Previous late payments

- Collections or charge-offs

- Limited or no credit history

Approval is primarily based on your ability to fund the security deposit, not your past credit mistakes.

Best Secured Credit Cards for Bad Credit (USA)

Below are commonly recognized secured card options in the U.S. market. Always review the issuer’s current terms before applying.

Discover It Secured Credit Card

- Reports to all three credit bureaus

- No annual fee

- Cashback rewards available

- Possible upgrade to unsecured card

Capital One Secured Credit Card

- Lower initial deposit options for some applicants

- Automatic credit line reviews

- Trusted national bank

Citi Secured Mastercard

- Simple structure

- Designed for credit rebuilding

- Fixed deposit equals credit limit

These cards are widely used by consumers rebuilding credit and often provide fast approval decisions once the deposit is confirmed.secured credit card for bad credit with instant approval

Who Qualifies for a Secured Credit Card for Bad Credit With Instant Approval

Getting approved is usually straightforward, but there are still basic requirements.

Basic Eligibility Requirements

- U.S. resident with valid Social Security number

- Stable income source

- Ability to fund the security deposit

- No recent bankruptcies (issuer-dependent)

Most issuers do not require a good credit score, and some may not rely heavily on traditional credit checks.

How Much Deposit Do You Need?

Security deposits usually range from $200 to $2,500, depending on the issuer.

Choosing the Right Deposit Amount

- Start with an amount you can comfortably afford

- Lower deposits reduce risk while rebuilding credit

- Larger deposits can help keep credit utilization low

Remember, the deposit is refundable when you close the account in good standing or upgrade to an unsecured card.

Who Should Apply for a Secured Credit Card for Bad Credit With Instant Approval?

A secured credit card improves credit the same way any other credit card does.

Key Credit Factors Affected

- Payment history: On-time payments are critical

- Credit utilization: Keep balances below 30% of your limit

- Credit age: Longer account history helps

- Credit mix: Adds a revolving credit line

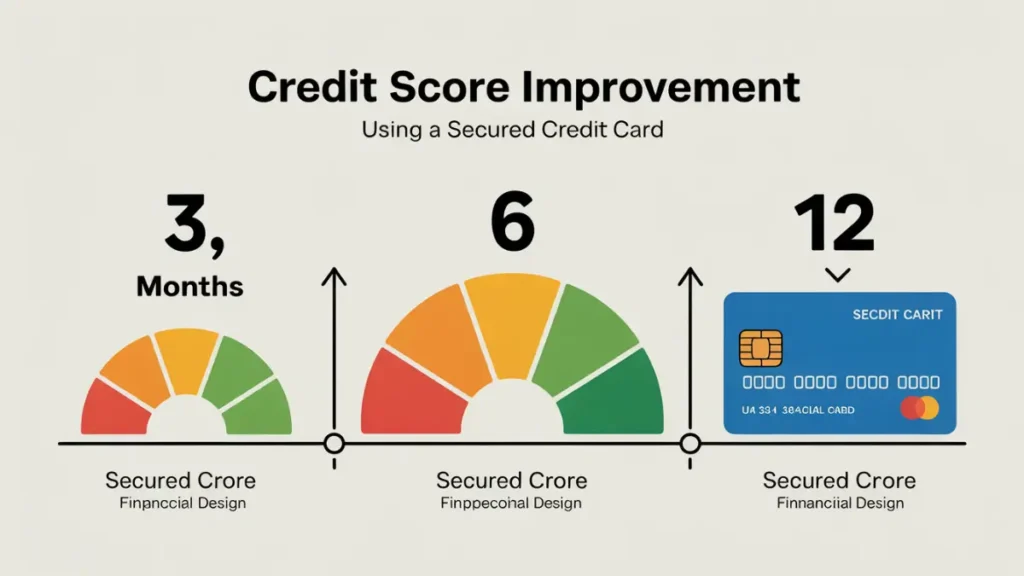

With consistent on-time payments, many users see noticeable improvement within 3 to 6 months.

Secured vs. Unsecured Credit Cards for Bad Credit

| Feature | Secured Credit Card | Unsecured Credit Card |

| Deposit required | Yes | No |

| Approval difficulty | Low | High |

| Credit reporting | Yes | Yes |

| Ideal for rebuilding | Yes | Limited |

| Risk to issuer | Low | High |

For bad credit applicants, secured cards are generally more realistic and safer than unsecured options.secured credit card for bad credit with instant approval

Common Mistakes to Avoid

Even with easy approval, mistakes can slow or reverse progress.

Avoid These Errors

- Maxing out the card

- Missing payment due dates

- Closing the account too early

- Applying for multiple cards at once

Using the card for small monthly expenses and paying the balance in full is the safest strategy.

Are Secured Credit Cards Guaranteed Approval?

No credit card is truly guaranteed, but secured cards have very high approval rates compared to traditional cards. As long as you meet basic requirements and provide the deposit, approval is likely.

How Long Does It Take to Improve Credit?

Credit improvement timelines vary, but a realistic expectation looks like this:

- 30 days: First on-time payment reported

- 60–90 days: Initial score movement

- 6–12 months: Stronger credit profile

Consistency matters more than speed.

Frequently Asked Questions

Do secured credit cards check your credit?

Most issuers perform a basic check, but approval is not heavily dependent on your score.

Can I get approved the same day?

Many issuers provide instant decisions, but physical cards take time to arrive.

Will I get my deposit back?

Yes, if the account is closed in good standing or upgraded.secured credit card for bad credit with instant approval

Can a secured card become unsecured?

Some issuers automatically review accounts and may upgrade you after responsible use.

Final Thoughts

A secured credit card for bad credit with instant approval is one of the most practical tools for rebuilding financial trust. It offers easier access, fast decisions, and real credit reporting that helps improve your score over time.

When used responsibly, a secured card can open the door to better financial products, lower interest rates, and long-term credit stability.secured credit card for bad credit with instant approval For individuals serious about improving their credit, it remains one of the most reliable starting points available.