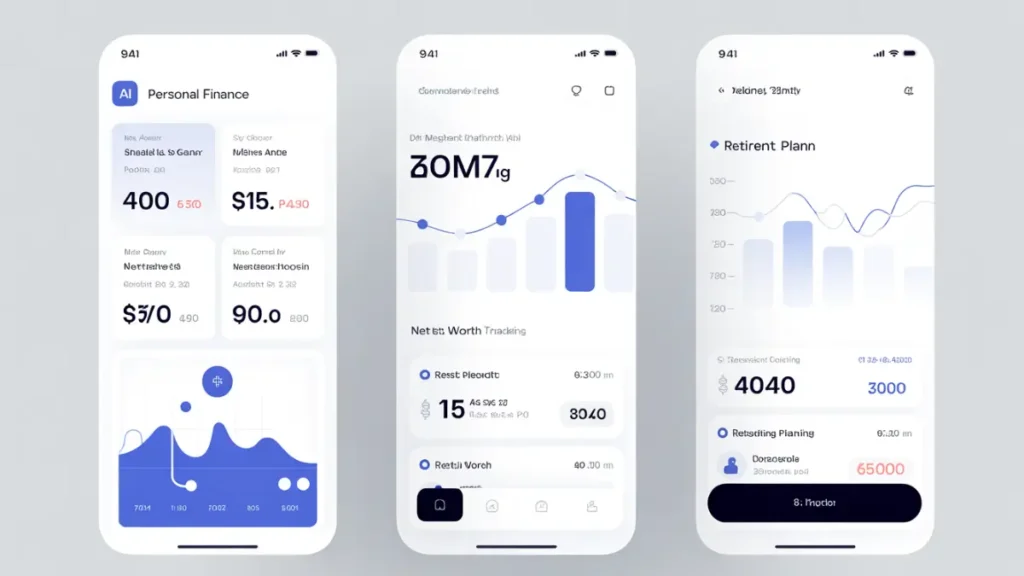

Imagine if your phone could tell you exactly where your money is going, warn you before you overspend, and automatically move cash into savings without you thinking about it. In 2026, this is no longer a fantasy. With the rise of AI-powered personal finance apps, your smartphone can now work as a full-time personal finance assistant.

Instead of using spreadsheets, notebooks, or dozens of different banking apps, you can manage your entire financial life from one place. From budgeting and expense tracking to investing and bill management, your phone can now handle tasks that once required a financial advisor.

In this guide, you’ll learn how to turn your phone into a personal finance assistant, the best apps to use in the USA, and how AI is changing the way Americans manage money.

What Is a Personal Finance Assistant?

A personal finance assistant is a digital tool that helps you manage your money automatically. It tracks your income, expenses, savings, investments, and financial goals in real time.

Traditionally, people used human financial advisors or manual budgeting methods. Today, AI-powered finance apps can perform many of the same tasks, but faster, cheaper, and more accurately.

A modern AI finance assistant can:

- Track every transaction automatically

- Categorize your spending

- Create smart budgets

- Suggest ways to save money

- Alert you about unusual activity

- Optimize your investments

- Pay bills and subscriptions

In simple terms, your phone becomes your money manager.

Why Your Phone Is the Best Finance Tool in 2026

Your smartphone is always with you. That makes it the perfect platform for managing personal finances.

Here’s why phones outperform traditional finance tools:

1. Real-Time Data

Your finance apps connect directly to your bank accounts and credit cards. This means you see your financial situation in real time, not days later.

2. AI Automation

AI analyzes your behavior and learns your spending habits. Over time, it gives smarter recommendations based on your lifestyle.

3. All-in-One Access

Instead of logging into multiple websites, everything is available in one dashboard.

4. Mobile Notifications

You get instant alerts when:

- A bill is due

- You overspend

- Your balance drops

- A subscription renews

This level of control was impossible a few years ago.

Best Apps to Turn Your Phone into a Finance Assistant (USA)

Here are some of the best personal finance apps used by Americans in 2026.

1. Rocket Money

Best for expense tracking and subscriptions.

Rocket Money connects to your accounts and shows where your money goes. It automatically finds unused subscriptions and helps you cancel them.

Key features:

- Smart budgeting

- Bill negotiation

- Subscription tracking

- Credit score monitoring

2. Mint (by Intuit)

Best all-around money manager.

Mint tracks income, expenses, credit cards, and investments in one place.

Key features:

- Automatic categorization

- Custom budgets

- Credit monitoring

- Financial insights

3. YNAB (You Need A Budget)

Best for serious budgeting.

YNAB focuses on giving every dollar a job. It’s ideal for people who want full control over spending.

Key features:

- Zero-based budgeting

- Goal tracking

- Debt payoff tools

- Financial education

4. Empower (formerly Personal Capital)

Best for investing and net worth.

Empower is great for users who want both budgeting and investment tracking.

Key features:

- Investment analysis

- Retirement planning

- Net worth tracking

- Cash flow insights

5. Cleo (AI Finance Assistant)

Best AI-based finance chatbot.

Cleo uses AI to talk to you like a real assistant. You can ask questions like “Can I afford this?” and get instant answers.

Key features:

- AI chat interface

- Smart savings

- Spending roast

- Financial coaching

How AI Helps You Manage Money Automatically

AI is the real game changer in personal finance.

Unlike traditional apps, AI systems don’t just show data. They analyze it and take action.

Here’s what AI does behind the scenes:

Pattern Recognition

AI studies your income, bills, and spending habits. It learns:

- When you get paid

- How much you usually spend

- Which categories cost the most

Predictive Analysis

AI predicts:

- Future expenses

- Cash shortages

- Overspending risks

Smart Recommendations

Based on your data, AI suggests:

- How much to save

- Where to cut spending

- Which bills to negotiate

- How to optimize investments

Behavioral Coaching

Some apps even act like financial coaches. They motivate you, warn you, and keep you accountable.

This turns your phone into a financial brain that works 24/7.

Features to Look for in Finance Assistant Apps

Not all apps are equal. When choosing a personal finance assistant, look for these features:

1. Bank Integration

The app should connect securely to:

- Checking accounts

- Savings accounts

- Credit cards

- Loans

2. AI Insights

The app should provide personalized recommendations, not just charts.

3. Budget Automation

Automatic budget creation based on your income.

4. Goal Tracking

Support for:

- Emergency fund

- Debt payoff

- Vacation savings

- Retirement

5. Security

Look for:

- Bank-level encryption

- Two-factor authentication

- Read-only access

Your financial data must be protected.

Real-Life Use Cases (USA Examples)

Case 1: Saving $500 a Month

Sarah from Texas used Rocket Money and Cleo together. The apps found unused subscriptions, optimized her budget, and automated savings. She now saves over $500 monthly.

Case 2: Paying Off Debt Faster

Mike from California used YNAB and Empower. By tracking expenses and using AI suggestions, he paid off $12,000 in credit card debt in one year.

Case 3: Investing Smarter

Jessica from New York uses Empower to track investments. The app rebalanced her portfolio and increased long-term returns.

These are real scenarios happening across the USA.

Pros and Cons of Using AI Finance Apps

Pros

- Fully automated money management

- Saves time and effort

- Improves financial awareness

- Reduces overspending

- Helps build wealth

Cons

- Requires sharing financial data

- Some features are paid

- Not a replacement for complex financial planning

- AI is only as good as the data

Still, for most people, benefits massively outweigh risks.

Security and Privacy Considerations

Security is the biggest concern for users.

Top finance apps use:

- AES-256 encryption

- Bank-level APIs

- Read-only access

- Zero-knowledge architecture

This means:

Apps cannot move your money. They can only view data.

To stay safe:

- Use strong passwords

- Enable 2FA

- Avoid unknown apps

- Read privacy policies

Your phone can be safe if you choose trusted apps.

Step-by-Step: Turn Your Phone into a Finance Assistant

Here’s a simple setup process:

Step 1: Choose One Main App

Start with Mint, Rocket Money, or YNAB.

Step 2: Connect Your Accounts

Link your:

- Bank

- Credit cards

- Loans

Step 3: Set Financial Goals

Add:

- Monthly budget

- Savings goals

- Debt targets

Step 4: Enable AI Features

Turn on:

- Smart insights

- Alerts

- Automated savings

Step 5: Review Weekly

Spend 10 minutes weekly reviewing suggestions.

That’s it. Your finance assistant is active.

FAQs – Personal Finance Assistant Apps

Can AI really manage my finances?

Yes. AI can track, analyze, and optimize your finances. However, you still make final decisions.

What is the best personal finance app in the USA?

Top choices are Mint, Rocket Money, YNAB, Empower, and Cleo.

Are finance apps safe to use?

Yes, if you use trusted apps with bank-level security.

Is there a free AI finance assistant?

Yes. Mint and Cleo offer free versions.

Can these apps help me save money?

Absolutely. Most users save between 10%–30% of monthly expenses.

Final Verdict: Your Phone Is Your New Financial Advisor

In 2026, managing money manually is outdated. With AI-powered personal finance apps, your phone can act as a full-time personal finance assistant.

It can:

- Track every dollar

- Predict future spending

- Automate savings

- Optimize investments

- Keep you financially disciplined

You no longer need complex spreadsheets or expensive advisors. Your smartphone already has everything you need to take control of your financial life.

If you want smarter money decisions, less stress, and more savings, the future of personal finance is already in your pocket.