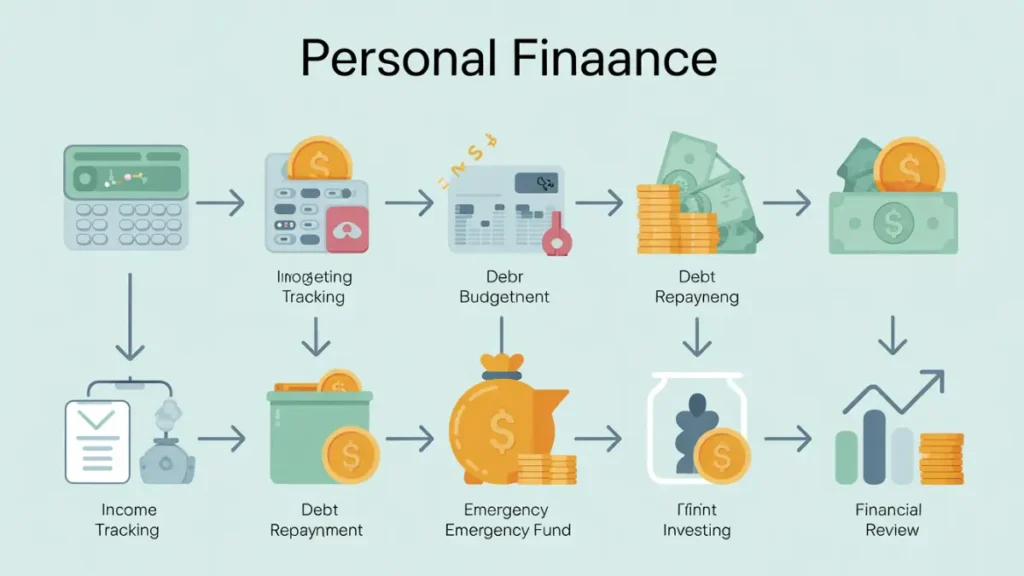

Managing personal finances can be overwhelming. With so many areas to handle – from budgeting and saving to investing and retirement planning – it’s easy to get lost in the complexity. Fortunately, using a personal finance flowchart can simplify the process and help you stay on track toward achieving your financial goals.

A personal finance flowchart is a visual guide that breaks down the different aspects of managing money. It lays out the steps you need to take to assess, plan, and execute your financial decisions. Whether you’re just starting out with budgeting or looking to improve your financial habits, a flowchart offers a clear path forward.

In this article, we will explore why a personal finance flowchart is essential, how to use it effectively, and the key steps involved in mastering your money.

Why a Personal Finance Flowchart is Essential

A personal finance flowchart is more than just a simple diagram. It’s a tool designed to provide clarity and direction in managing your money. Many people struggle with finances because they don’t know where to start or how to structure their approach. A flowchart gives you a step-by-step visual representation of the decisions you need to make and the actions you need to take.

Here’s why a personal finance flowchart is an indispensable tool:

- Simplicity: A flowchart distills complex financial concepts into easy-to-understand steps. You no longer need to juggle multiple tasks or worry about missing important details.

- Clarity: It helps you visualize the process of managing your money. With clear arrows pointing to different actions, you know exactly what to do next at each stage.

- Better Decision Making: A finance flowchart can help you make better decisions by laying out all the possibilities and outcomes, helping you assess your options more clearly.

- Track Progress: With a visual map, it’s easier to track where you are in your financial journey and what still needs to be done. You can stay on course and avoid feeling overwhelmed.

How to Use a Personal Finance Flowchart Effectively

The key to using a personal finance flowchart effectively lies in understanding each part of it and following the steps in the correct order. Here’s how to use it:

- Start with Assessing Your Current Financial Situation

The first step in any personal finance flowchart is to assess where you stand financially. This includes evaluating your income, expenses, savings, debts, and investments.- List all sources of income.

- Track monthly expenses and categorize them (e.g., rent, utilities, groceries, insurance).

- List all debts (student loans, credit card bills, mortgage).

- Evaluate your savings, emergency fund, and current investments.

- List all sources of income.

- This will give you a clear picture of your financial health and help you identify areas that need improvement.

- Set Clear Financial Goals

Once you have assessed your current financial situation, the next step is to set clear financial goals. These could be short-term goals like saving for a vacation or paying off credit card debt, or long-term goals like buying a home or retirement planning.

Your goals should be SMART (Specific, Measurable, Achievable, Relevant, and Time-bound). For example, a SMART goal might be: “Save $5,000 for an emergency fund within the next year.” - Create a Budget

With your goals in mind, the next step in the flowchart is creating a budget. A budget is a critical tool for ensuring that you are living within your means and allocating enough money toward your goals.- Track your monthly income and expenses.

- Identify areas where you can cut back on unnecessary spending.

- Allocate a portion of your income toward savings and investments.

- Track your monthly income and expenses.

- Your budget should be flexible but disciplined enough to ensure that you stay on track.

- Pay Off High-Interest Debts

If you have any high-interest debt, such as credit card bills, student loans, or payday loans, the next step in the flowchart is to prioritize paying them off. Debt can severely impact your financial health and prevent you from achieving other goals.

Focus on paying off the highest-interest debt first while making minimum payments on others. Once you pay off one debt, apply the freed-up money toward paying off the next one. This approach is often referred to as the debt snowball method. - Start Saving for an Emergency Fund

An emergency fund is a financial safety net that can help you weather unexpected expenses, such as medical bills or car repairs. A good rule of thumb is to save three to six months’ worth of living expenses.

You can create a separate savings account specifically for this fund, ensuring that it’s easily accessible but not too easy to dip into. - Invest for the Future

Once you’ve paid off high-interest debt and established an emergency fund, the next step in your personal finance flowchart is to start investing. Investing allows your money to grow over time and helps you build wealth for retirement and long-term goals.- Consider investing in a 401(k) or an IRA if you’re working toward retirement.

- Diversify your investments by including stocks, bonds, real estate, and other asset classes.

- Consult with a financial advisor if needed to build a tailored investment strategy.

- Consider investing in a 401(k) or an IRA if you’re working toward retirement.

- Review and Adjust Regularly

Financial plans aren’t static. Over time, you may need to adjust your flowchart as your income, expenses, goals, and life circumstances change.- Review your financial plan at least once a year.

- Make adjustments based on any major life changes, such as a job change, marriage, or buying a home.

- Ensure that you continue to stay on track and make adjustments as needed.

- Review your financial plan at least once a year.

Benefits of Using a Personal Finance Flowchart

A personal finance flowchart offers numerous benefits, including:

- Improved Financial Control: By following a flowchart, you can take control of your financial future by breaking down your goals into actionable steps.

- Increased Savings and Investment: Having a visual plan helps you allocate money toward savings and investments rather than frivolous spending.

- Faster Debt Repayment: With a clear plan for tackling debt, you can pay it off faster and save on interest payments.

- Financial Security: With budgeting, saving, and investing, you’re more likely to achieve financial security and independence.

Key Tips for Creating Your Own Personal Finance Flowchart

While there are many pre-made personal finance flowcharts available online, you may find it beneficial to create your own customized version. Here are some tips:

- Be Specific: Customize your flowchart to reflect your unique financial goals and priorities.

- Keep It Simple: Avoid overcomplicating your flowchart. Stick to clear, actionable steps.

- Use Color and Design: Make your flowchart visually appealing by using colors and designs that help you navigate it easily.

- Update Regularly: As your financial situation evolves, be sure to update your flowchart to reflect any changes.

Conclusion

Managing personal finances doesn’t have to be daunting. By using a personal finance flowchart, you can simplify the process and gain better control over your money. Whether you’re just starting out on your financial journey or looking for ways to optimize your current strategy, a flowchart offers a clear, structured path forward.

Remember, the key to success is consistency. Stick to your flowchart, adjust as necessary, and keep track of your progress. With the right tools and strategies, you can achieve financial freedom and build a secure financial future.