Crypto & Smart Investing for Beginners is no longer just for experts or Wall Street traders. The world of investing has changed dramatically in the last decade, opening new doors for everyday individuals armed with smartphones and curiosity. One of the biggest drivers of this revolution is cryptocurrency digital assets that have redefined how people think about money, risk, and wealth creation.

For beginners, crypto investing can feel overwhelming. The market moves fast, new tokens appear daily, and headlines swing from fortune to disaster in seconds. Yet, with the right mindset and smart investing principles, anyone can start safely and profitably. This guide breaks down everything you need to know about crypto and smart investing for beginners from understanding what crypto is to creating a balanced, intelligent investment strategy for 2025 and beyond.

In this guide on Crypto & Smart Investing for Beginners, you’ll learn how to start safely, manage risks, and make informed financial decisions in 2025.

What Is Cryptocurrency and Why It Matters for Investors

Cryptocurrency is a digital form of money secured by cryptography and powered by blockchain technology — a decentralized system that records transactions publicly and transparently. Unlike traditional currencies controlled by central banks, cryptocurrencies are maintained by global networks of computers.

For investors, the appeal lies in accessibility and independence. There are no intermediaries, no banking delays, and no geographic limitations. You can buy, sell, or transfer assets within minutes anywhere in the world.

Bitcoin, the first cryptocurrency, launched in 2009 and has since inspired thousands of alternatives like Ethereum, Solana, and Cardano. Today, the market value of all cryptocurrencies exceeds $2 trillion, proving that digital assets are no longer a niche experiment — they’re a legitimate investment class.

Why Crypto Investing Attracts Beginners

New investors are drawn to cryptocurrency for several reasons that traditional markets rarely offer.

1. Accessibility

Anyone can begin with as little as $10 using platforms like Coinbase or Binance. This democratization makes investing possible even for students or part-time earners.

2. 24/7 Market

Unlike stock exchanges that close daily, crypto markets operate 24 hours a day, 7 days a week — perfect for people who want flexibility.

3. High Growth Potential

Bitcoin was once valued at less than a penny. Ethereum was under $1 in its early days. Early adopters who believed in these projects saw returns beyond imagination.

4. Innovation and Utility

Crypto isn’t just about trading coins. It’s powering new industries like DeFi (Decentralized Finance), NFTs, and Web3 applications. Beginners see opportunity in being part of something transformative.

Smart Investing Principles in Crypto & Smart Investing for Beginners

Crypto & Smart Investing for Beginners is all about building discipline, not chasing hype.

- Start Small, Learn Fast

Begin with small amounts you can afford to lose. Focus on learning rather than chasing profits. - Diversify Your Portfolio

Don’t put all your funds into one token. Spread your investments across Bitcoin, Ethereum, and a few promising altcoins to balance risk. - Do Your Research (DYOR)

Always research project fundamentals: team credibility, use case, tokenomics, and community trust. Avoid coins that exist purely for hype. - Use Trusted Exchanges

Stick with regulated, secure platforms such as Coinbase, Kraken, or Binance.US. - Secure Your Assets

Move your crypto to hardware or cold wallets when holding long term. Remember: not your keys, not your coins. - Plan for Volatility

Crypto prices can rise or fall 20% in a day. Use stop-losses and avoid emotional trading. - Keep Learning

Subscribe to reliable sources like CoinDesk or Investopedia Crypto to stay updated.

Smart investing is about risk control, patience, and education — not luck.Crypto & Smart Investing for Beginners

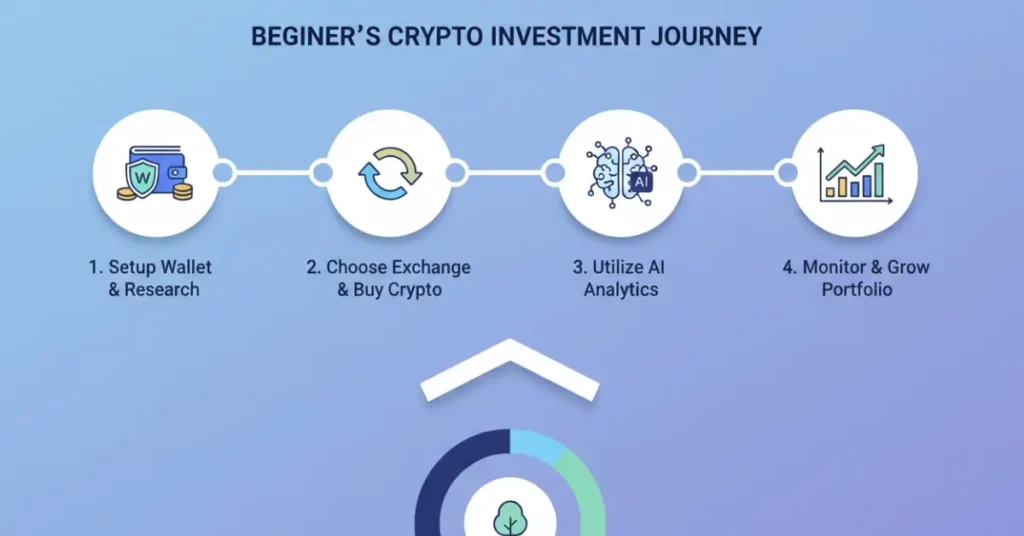

How to Start Crypto & Smart Investing for Beginners: Step-by-Step Guide

Following these steps ensures that Crypto & Smart Investing for Beginners remains simple and practical for anyone starting out.

- Choose a Reputable Exchange

Create an account on platforms like Coinbase or Kraken. These are beginner-friendly and regulated in the U.S. - Verify Your Identity

Complete KYC (Know Your Customer) to unlock full account features. - Deposit Funds

Link your bank account or card and add your initial investment budget. - Select Beginner-Friendly Coins

Start with stable, established assets like Bitcoin (BTC) and Ethereum (ETH). Avoid unknown tokens early on. - Make Your First Purchase

Buy a small amount and observe how the price moves. Learn how fees and confirmations work. - Store Safely

Use exchange wallets for short-term storage and hardware wallets for long-term security. - Track and Review

Use portfolio tracking apps such as CoinStats or Delta to monitor your gains and losses.

This method helps you learn the mechanics of crypto without unnecessary risks. Crypto & Smart Investing for Beginners

Best Cryptocurrencies for Beginners in 2025

| Cryptocurrency | Why It’s Good for Beginners | Risk Level |

| Bitcoin (BTC) | The original, most stable, and widely recognized | Low |

| Ethereum (ETH) | Supports smart contracts, NFTs, and DeFi | Medium |

| Solana (SOL) | Fast transactions and low fees | Medium |

| Cardano (ADA) | Strong academic foundation and eco-friendly | Medium |

| USDT / USDC (Stablecoins) | Pegged to USD; ideal for saving or transfers | Very Low |

These coins are ideal choices discussed throughout our Crypto & Smart Investing for Beginners guide for new U.S. investors.

Common Mistakes New Crypto Investors Should Avoid

Avoiding these mistakes is essential for anyone serious about Crypto & Smart Investing for Beginners in 2025 and beyond.

- Chasing Hype Coins

Viral tokens often crash after the initial excitement. Stick to projects with purpose. - Neglecting Security

Never share private keys or recovery phrases. Many scams start from fake websites or emails. - Investing More Than You Can Afford

Crypto is volatile. Treat it as a high-risk, high-reward asset class. - Ignoring Research

FOMO (Fear of Missing Out) leads to poor decisions. Spend time understanding what you’re buying. - Leaving Funds on Exchanges

Exchanges can be hacked. Move assets to personal wallets after purchase. - Lack of Patience

Real gains come from long-term holding, not day trading chaos.

Avoiding these mistakes will keep your journey profitable and secure. Crypto & Smart Investing for Beginners

Smart Investment Tips to Build Long-Term Wealth

Building sustainable wealth in crypto isn’t about luck — it’s strategy and consistency.

1. Practice Dollar-Cost Averaging (DCA)

Invest a fixed amount weekly or monthly, regardless of price. Over time, this averages out market volatility.

2. Rebalance Regularly

Review your portfolio quarterly. If one asset grows too large, sell a portion and reinvest elsewhere to maintain balance.

3. Explore Staking and Yield

Some cryptocurrencies let you stake your tokens to earn passive income. Examples: Ethereum, Cardano, and Solana.

4. Focus on Education, Not Prediction

No one can predict short-term prices. Instead, learn market fundamentals and macro trends.

5. Combine Traditional Investing

Smart investors mix crypto with ETFs, stocks, or index funds for stability.

6. Plan Your Exit

Set profit targets and stick to them. Emotional greed can erase months of gains.

Long-term wealth comes from disciplined strategies, not quick wins.

Top Tips for Success in Crypto & Smart Investing for Beginners (2025 Edition)

As the market matures, crypto investing is merging with mainstream finance. Here are key trends shaping the future:

- AI-Driven Investing Tools

Artificial intelligence is analyzing blockchain data to predict trends and help users automate portfolios. - Regulated Bitcoin ETFs

More countries are approving Bitcoin and Ethereum ETFs, allowing traditional investors to enter safely. - Tokenized Assets

Real estate, art, and even stocks are becoming tokenized on blockchain, increasing liquidity. - Eco-Friendly Cryptocurrencies

Projects like Cardano and Avalanche are focusing on sustainability to address energy concerns. - Educational Accessibility

Free courses and mobile apps are teaching millions how to invest smartly in crypto.

The future belongs to investors who combine technology with knowledge and patience.Crypto & Smart Investing for Beginners.

FAQs

Q1: What is the safest cryptocurrency for beginners?

Bitcoin remains the safest due to its stability and large community. Ethereum is a close second.Crypto & Smart Investing for Beginners.

Q2: How much should a beginner invest in crypto?

Start small — between $50 and $200 — and increase only after understanding the market.

Q3: Can you make money with small crypto investments?

Yes. With strategies like dollar-cost averaging and staking, small consistent investments can grow over time.

Q4: What’s the difference between investing and trading?

Investing is long-term and research-based, while trading is short-term speculation. Beginners should focus on investing.

Q5: How can beginners avoid crypto scams?

Avoid offers that guarantee profits, double-check URLs, and never share wallet recovery phrases.

Conclusion

Crypto & Smart Investing for Beginners is about patience, education, and strategy — not luck. The more you learn, the smarter your investments become.

However, success in crypto doesn’t come from luck or following hype—it comes from smart, disciplined investing. Learn constantly, diversify wisely, and think long-term. The crypto market rewards patience and punishes emotion.

As you step into this world, remember: technology evolves fast, but financial wisdom never goes out of style. Start small, stay informed, and let your knowledge—not your fear—guide your crypto journey.