In 2026, more Americans are turning to artificial intelligence to take control of their money. Rising inflation, job uncertainty, medical bills, and unexpected expenses have made one thing clear: having a strong emergency fund is no longer optional. The old advice of saving slowly in a bank account is being replaced by something smarter, faster, and more powerful — AI-powered money tools.

Thousands of Americans are now quietly building $5,000 emergency funds in record time by using AI to automate saving, eliminate wasteful spending, and create intelligent financial plans. The best part? They are doing it without working extra jobs or making painful lifestyle changes.

This guide will show you exactly how to build your own $5,000 emergency fund faster using AI.

Why Every American Needs a $5,000 Emergency Fund

An emergency fund is the foundation of financial security. It protects you from:

- Medical emergencies

- Job loss

- Car repairs

- Rent or mortgage gaps

- Family emergencies

In the United States, over 60% of adults cannot cover a $1,000 emergency without borrowing money. That is dangerous. When you rely on credit cards or loans, you stay trapped in debt.

A $5,000 emergency fund creates freedom. It gives you peace of mind, protects your credit score, and allows you to make better life decisions without fear.

But the real problem is not knowing you need it. The problem is how to build it fast when money already feels tight.

That is where AI changes everything.

How AI Is Changing the Way People Save Money

Traditional budgeting fails because it depends on human discipline. People forget, overspend, and give up. AI removes emotion from money.

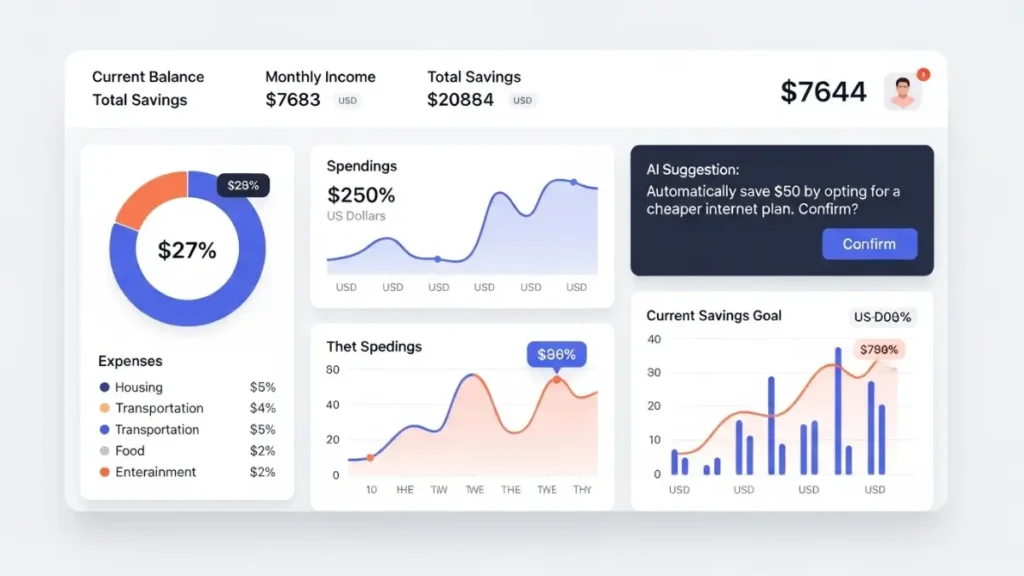

AI-powered financial apps analyze:

- Your income

- Your spending

- Your bills

- Your habits

Then they automatically decide:

- How much you can save

- When to move money

- Where to cut costs

AI works in the background 24/7. It does not get tired. It does not forget. It constantly optimizes your finances to help you reach your savings goal faster.

This is why AI savings apps are now one of the most powerful tools for building an emergency fund in 2026.

How Much Should You Save Each Month to Reach $5,000?

Let’s look at simple math.

| Monthly Saving | Time to Reach $5,000 |

| $100 | 50 months |

| $250 | 20 months |

| $500 | 10 months |

| $750 | 7 months |

| $1,000 | 5 months |

Most people think they cannot save $500 or more per month. But once AI starts eliminating wasted spending and optimizing bills, many Americans find hundreds of dollars they did not even know they were losing.

AI does not ask you to be perfect. It finds extra money automatically.

Best AI Apps That Help Build an Emergency Fund

Here are some of the most powerful AI savings apps Americans are using today.

| AI App | What It Does | Best For |

| Cleo | AI budgeting assistant | Beginners |

| Rocket Money | Cancels subscriptions and tracks bills | High monthly expenses |

| Qapital | Automated savings goals | Emergency funds |

| Digit | AI that saves small amounts daily | Fast savings |

| YNAB | Smart budgeting with AI insights | Serious planners |

These tools work together to:

- Find hidden spending

- Cancel unnecessary bills

- Automatically move money into savings

- Predict cash flow

This creates a system that builds your emergency fund without stress.

Step-by-Step AI System to Reach $5,000

Here is the exact system thousands of Americans are using.

Step 1: Connect All Your Accounts

Link your bank, credit cards, and bills to your AI apps. This gives the system full visibility into your money.

Step 2: Let AI Analyze Your Spending

Within days, AI finds:

- Subscriptions you forgot

- Overpriced phone plans

- Streaming services

- Banking fees

- Food delivery waste

Most people save $200–$400 in the first month just by removing waste.

Step 3: Set a $5,000 Emergency Fund Goal

Tell the AI your target. It will calculate how much to save weekly or monthly.

Step 4: Turn On Auto-Savings

AI automatically moves money into your emergency fund when it knows you can afford it.

This means:

- You save without thinking

- You never overdraft

- You never forget

Step 5: Use a High-Yield Savings Account

Keep your emergency fund in an online savings account that pays interest. This allows your money to grow while staying safe.

Real Example: How AI Builds Your Emergency Fund

Let’s look at a real-world example.

Sarah earns $4,200 per month after taxes. She thought she had no money to save. After connecting her accounts to AI tools, this happened:

- $120 canceled subscriptions

- $90 cheaper phone plan

- $150 reduced food delivery

- $80 lower internet bill

Total extra cash found: $440 per month

AI then moved an additional $300 automatically from her checking account.

Sarah saved $740 per month without changing her lifestyle.

At that speed, she reached $5,000 in just 7 months.

This is not rare. This is what AI does.

Why Traditional Saving Fails

Most people fail because:

- They forget to save

- They rely on willpower

- They do not track spending

- They underestimate small purchases

AI fixes all of this by:

- Monitoring every transaction

- Adjusting savings in real time

- Protecting your cash flow

- Eliminating human mistakes

That is why AI is now the fastest way to build an emergency fund.

How Fast Can You Reach $5,000 With AI?

Most Americans using AI savings apps reach $5,000 in 5 to 12 months, depending on income and spending habits.

Without AI, it can take years.

With AI, your money becomes organized, disciplined, and optimized.

Best Practices to Maximize Your Emergency Fund

- Use multiple AI tools

- Keep savings separate from checking

- Never touch your emergency fund unless it is a real emergency

- Increase savings whenever income rises

- Review AI reports monthly

Common Mistakes That Keep People Broke

- Keeping money in checking accounts

- Not canceling unused subscriptions

- Not tracking spending

- Saving whatever is left instead of saving first

- Using credit cards for emergencies

AI prevents these mistakes automatically.

Why an Emergency Fund Is Better Than Investing First

Investing is important, but without an emergency fund, you will be forced to sell investments when life goes wrong.

Your $5,000 emergency fund is your shield. It keeps you from debt, stress, and financial panic.

Once it is built, then you can invest safely.

FAQs

How much should I have in an emergency fund?

Most financial experts recommend at least three to six months of expenses. For most Americans, $5,000 is the perfect starting point.

Can AI really help save money?

Yes. AI analyzes spending patterns and automatically finds ways to reduce waste and increase savings.

What is the best AI savings app?

Apps like Cleo, Digit, Rocket Money, and Qapital are among the most effective for building emergency funds.

How fast can I save $5,000?

With AI, many Americans reach this goal in 5 to 10 months.

Should I invest before building an emergency fund?

No. An emergency fund should always come first.

Final Thoughts

The financial world has changed. You no longer have to struggle alone. AI now does the hard work for you.

If you want financial security, peace of mind, and freedom from money stress, start building your $5,000 emergency fund today — with AI.