The New Era of Wealth Building

Robo-Advisor Tips are changing the way people grow and manage their money. In today’s fast-paced financial world, these AI-powered investment platforms use smart automation to help you build wealth faster and smarter than ever before.

If you’re aiming to grow your wealth fast without needing deep financial knowledge, robo-advisors can be your strongest ally. Let’s explore expert-backed tips to maximize your returns and make the most of these digital financial tools.

What Are Robo-Advisors?

A robo-advisor is an online platform that uses artificial intelligence (AI) and data-driven algorithms to manage your investments automatically. Instead of paying a human financial advisor, you simply answer a few questions about your financial goals, risk tolerance, and timeline. The robo-advisor then builds a diversified portfolio—usually using ETFs (Exchange-Traded Funds)—and adjusts it over time to match your goals.

How They Work

- Questionnaire Setup: You enter your investment goals, risk profile, and income.

- Automated Portfolio Creation: The AI selects a mix of assets like stocks, bonds, or ETFs.

- Automatic Rebalancing: It monitors your investments and automatically adjusts when needed.

- Tax Optimization: Many platforms use tax-loss harvesting to minimize your tax burden.

These Robo-Advisor Tips help you automate your wealth growth efficiently.

How Robo-Advisors Grow Wealth Faster

Robo-advisors are designed to make smart financial decisions using data and automation. Here’s why they help your money grow faster compared to traditional investing methods:

1. Compound Growth with Automated Reinvesting

Robo-advisors automatically reinvest dividends and interest earned on your investments. This compounding effect allows your money to grow faster over time, maximizing every dollar you invest.

2. Lower Fees Mean Higher Returns

Human advisors often charge 1–2% of your total assets annually. In contrast, robo-advisors typically charge between 0.25% to 0.50%. That difference compounds significantly over the years, putting more money in your pocket.

3. Consistent, Emotion-Free Investing

The biggest enemy of fast wealth growth is emotional decision-making. Robo-advisors eliminate fear and greed from the equation, following proven financial models to keep your strategy on track—no panic-selling or impulsive buying.

4. Diversification Without Effort

A diversified portfolio spreads your risk across various asset classes. Robo-advisors build this automatically, balancing exposure between stocks, bonds, and ETFs. This reduces potential losses while maximizing stable growth.

5. 24/7 Market Monitoring

Unlike traditional advisors who work fixed hours, robo-advisors monitor markets around the clock. They react instantly to changes, ensuring your portfolio always aligns with your goals and market conditions.

Top Robo-Advisor Tips to Grow Wealth Fast

Ready to make your money work harder for you? Follow these proven robo-advisor tips to accelerate your financial growth.

1. Start Investing Early

The earlier you start, the more time compound interest has to work its magic. Even a small monthly contribution can grow into a large sum over time. Start now, even if it’s just $50 or $100 a month.

2. Reinvest All Your Dividends

Ensure your robo-advisor is set to automatically reinvest dividends. This allows your investment earnings to generate even more earnings one of the easiest ways to boost long-term growth.

3. Choose a Robo-Advisor with Tax-Loss Harvesting

Tax-loss harvesting helps reduce the taxes you owe by offsetting capital gains with capital losses.Robo-Advisor Tips Platforms like Betterment and Wealthfront use this strategy automatically, improving your post-tax returns.

4. Optimize Your Risk Level

During your setup, you’ll choose a risk tolerance. Younger investors should generally select higher-risk options for greater growth potential. If you’re close to retirement, a moderate or conservative plan is safer.

5. Automate Your Contributions

Set up automatic deposits to your investment account each month. Consistency is key—automating your investments removes procrastination and ensures your wealth keeps growing effortlessly.

6. Review and Adjust Annually

While robo-advisors handle most of the work, reviewing your progress once a year is smart. Adjust your goals or risk profile as your financial situation evolves.

7. Leverage Goal-Based Investing

Most robo-advisors allow you to set goals like “Buy a House,” “Retirement,” or “Vacation Fund.” Assigning a goal helps the AI fine-tune your investment mix for faster results.

8. Use Tax-Advantaged Accounts

If available, use IRAs or 401(k)s with your robo-advisor. Combining tax benefits with automation can significantly accelerate your wealth-building.

9. Compare Platform Features

Each robo-advisor offers unique tools. For instance:

- Betterment: Great for goal-based investing.

- Wealthfront: Best for advanced tax strategies.

- SoFi Invest: Ideal for beginners with no management fees.

- Fidelity Go: Strong for long-term retirement plans.

10. Keep Fees in Check

Small management fees can add up over time.Robo-Advisor Tips Always choose platforms that are transparent and offer value for the percentage they charge.

Pros and Cons of Using Robo-Advisors

| Pros | Cons |

| Low management fees | Limited customization options |

| Automated, emotion-free investing | No human advisor relationship |

| Diversification built-in | May underperform in unusual markets |

| Tax optimization features | Requires digital literacy |

| Accessible to beginners | Annual returns depend on market behavior |

While robo-advisors simplify investing, it’s important to understand that market risks still exist. However, with consistency and patience, these platforms have proven to outperform many traditional portfolios over the long term.

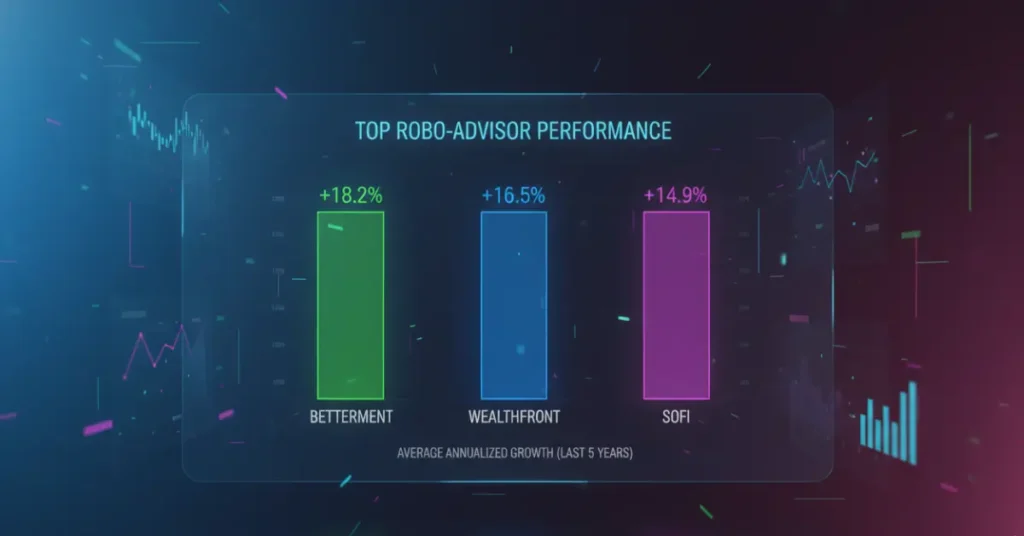

Best Robo-Advisors for Fast Wealth Growth in 2025

Here are some top robo-advisors that combine performance, affordability, and innovation for USA investors in 2025:

| Platform | Management Fee | Best For | Key Feature |

| Betterment | 0.25% | Beginners & goal-based investors | Tax-loss harvesting, automatic rebalancing |

| Wealthfront | 0.25% | Advanced investors | Smart tax optimization tools |

| SoFi Automated Investing | $0 | Budget-conscious users | No management fees, free financial planners |

| Fidelity Go | 0.35% | Long-term retirement savers | Trusted brand, strong performance |

| M1 Finance | 0.00% | DIY investors | Customizable portfolios, auto investing |

If you follow these Robo-Advisor Tips, your investments will stay consistent and optimized.

Final Thoughts: Let Technology Grow Your Wealth

Robo-advisors have revolutionized personal finance by combining AI efficiency with smart investing principles. They make it possible for anyone—from students to professionals—to start building wealth quickly, without needing years of market experience.

By following the tips above—starting early, automating your investments, minimizing taxes, and staying consistent—you can set your money on autopilot and watch your wealth multiply over time.

Remember: growing wealth fast doesn’t mean chasing risky returns—it means using automation to make your money work harder, smarter, and more efficiently.

By applying these proven Robo-Advisor Tips, you can make your money work harder in 2025.

FAQs About Robo-Advisors

1. Are robo-advisors good for beginners?

Yes. Robo-advisors are ideal for beginners because they automate complex investment decisions, manage risk, and provide portfolio diversification with minimal effort.“These Robo-Advisor Tips are ideal for both beginners and experienced investors.”

2. Can robo-advisors make you rich fast?

While robo-advisors won’t make you rich overnight, they can accelerate wealth growth over time through compounding, low fees, and intelligent reinvestment strategies.

3. Are robo-advisors safe?

Most robo-advisors are registered with the SEC and provide SIPC insurance up to $500,000. They use advanced encryption to keep your data and funds secure.

4. What’s the minimum to start investing?

Many platforms allow you to start with as little as $10 to $100, making it accessible for everyone to begin their investing journey.

5. Which robo-advisor is best for fast growth?

Platforms like Wealthfront and Betterment have a strong track record of optimizing returns using data-driven strategies, making them great choices for faster growth.

1 thought on “Robo-Advisor Tips: Grow Wealth Fast”