AI tax tools 2025 are transforming tax season, making it less stressful for employees, freelancers, and business owners. With smarter automation, these tools help you file accurately, uncover hidden deductions, and reduce your overall tax burden.

Thankfully, Artificial Intelligence (AI) is transforming the way we approach taxes. In 2025, AI-powered tax tools are helping individuals and businesses lower their tax burden, uncover hidden deductions, automate compliance, and save valuable time.

In this article, we will explore the best AI tools that lower your tax burden, their features, benefits, and how to get started with AI-driven tax planning.

Why Use AI for Tax Planning in 2025

Traditional tax preparation involves manual data entry, confusing IRS forms, and sometimes expensive consultations with human tax professionals. Even then, you might miss deductions or credits.

AI solves these problems by AI tax tools 2025:

- Analyzing your financial data automatically – no more spreadsheets.

- Identifying every possible deduction or credit based on your spending patterns.

- Providing real-time tax estimates so you can plan ahead, not just at filing time.

- Reducing errors that can trigger audits or penalties.

In short, AI makes tax planning smarter, faster, and cheaper—a win for individuals and businesses alike.

Best AI Tax Tools 2025 That Lower Your Tax Burden

Here’s a look at some of the top AI-powered tax tools available in 2025, along with their unique features, benefits, and pricing.AI tax tools 2025.

| AI Tool | Best For | Key Features | Pricing |

| TurboTax with Intuit Assist | Individuals & families | AI tax prep, deduction finder, step-by-step filing help | Starts at $0 (Free Edition) |

| H&R Block AI Tax Pro | Individuals & businesses | AI-assisted filing, live CPA help, audit protection | Starts at $0 (Basic) |

| TaxAct Xpert Assist | DIY filers | AI guidance, accuracy guarantee, expert chat | $0 – $79 depending on plan |

| Keeper Tax | Freelancers & gig workers | AI scans bank statements to find write-offs | $16/month |

| FlyFin AI | Self-employed professionals | Fully automated tax filing, CPA review | $7/month (basic) |

| Avalara | Small & medium businesses | AI-driven sales tax automation, compliance reports | Custom pricing |

TurboTax with AI (Intuit Assist)

TurboTax is one of the most popular tax software solutions in the US, and its AI-powered Intuit Assist makes filing even easier.AI tax tools 2025 The AI guides you through each step, explains tax jargon in plain English, and automatically searches for deductions you might have missed.

Best For: Individuals and families looking for a reliable, easy-to-use solution.AI tax tools 2025.

Pros:

✅ Simple, user-friendly interface

✅ Free edition for simple tax returns

✅ AI explains complex IRS terms

Cons:

❌ Paid tiers can get expensive for complex filings

H&R Block AI Tax Pro

H&R Block combines AI with access to real human tax pros. Their AI-driven interface helps you prepare your return quickly, while their network of CPAs can step in if you need extra help.

Best For: Individuals or small business owners who want AI + human review.

Pros:

✅ Strong audit support

✅ In-person help available

✅ AI guidance is beginner-friendly

TaxAct Xpert Assist

TaxAct’s AI helps you maximize deductions and double-checks your entries for accuracy. You also get access to live tax experts who can answer questions.AI tax tools 2025.

Best For: DIY filers who still want a professional to review their work.

Pros:

✅ Affordable compared to competitors

✅ Accuracy guarantee

✅ Real-time expert chat

Keeper Tax – One of the Best AI Tax Tools 2025 for Freelancers

Keeper Tax is built for gig workers and freelancers. It scans your bank and credit card transactions to identify potential tax write-offs and sends reminders to save receipts.

Best For: Freelancers, rideshare drivers, content creators.

Pros:

✅ Finds hidden deductions

✅ Mobile app is very convenient

✅ Low monthly cost

FlyFin AI

FlyFin is another great option for self-employed individuals. It uses AI to automate the entire tax filing process and has human CPAs review everything before submission.

Best For: Busy entrepreneurs who want a hands-off solution.AI tax tools 2025.

Pros:

✅ Fully automated

✅ CPA-reviewed filing

✅ Affordable monthly plans

Avalara

Avalara is designed for businesses that need to handle sales tax compliance across multiple states. Its AI automatically calculates and files sales taxes, keeping you compliant.

Best For: Small and medium-sized businesses with complex tax requirements.AI tax tools 2025

Pros:

✅ Automates sales tax collection

✅ Reduces risk of non-compliance

✅ Scales with business growth

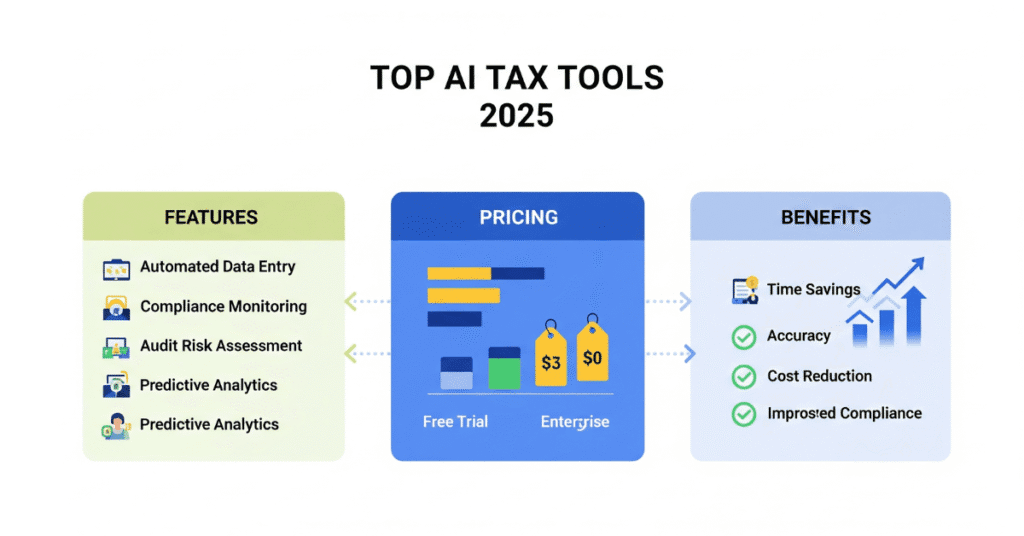

Benefits of AI Tax Tools 2025 for Smarter Tax Planning

Using AI-driven tax tools provides multiple benefits AI tax tools 2025:

- Maximized Savings: AI analyzes spending data to uncover deductions.

- Error Reduction: Minimizes IRS flags and penalties.

- Time Savings: Automates calculations and form filling.

- Stress-Free Experience: Provides step-by-step guidance and peace of mind.

- Real-Time Planning: Helps you plan year-round, not just during tax season.

How to Choose the Right AI Tax Tools 2025 for Your Needs

When selecting an AI-powered tax solution, consider:

- Your Filer Type: Are you a W-2 employee, freelancer, or small business owner?

- Integration Needs: Some tools connect directly to bank accounts and accounting software.

- Budget: Look for transparent pricing—avoid tools that charge hidden fees.

- Support: Do you want 24/7 customer support or CPA access?

Step-by-Step Guide to Start Using AI for Taxes

- Pick a Tool: Compare TurboTax, Keeper Tax, FlyFin, and others.

- Sign Up: Create an account and set up your tax profile.

- Connect Accounts: Link your bank accounts and credit cards for automatic expense tracking.

- Review AI Suggestions: The AI will highlight deductions and credits.

- File with One Click: Most platforms let you e-file directly with the IRS.

Common Mistakes to Avoid

- Blindly Trusting AI: Always double-check your data before filing.

- Forgetting Deadlines: AI can remind you, but you must still take action.

- Ignoring Quarterly Taxes: Freelancers should use AI tools to plan for estimated tax payments.

The Future of AI in Tax Planning

By 2026 and beyond, expect even more advanced AI-driven features:

- Predictive Tax Planning: AI will forecast next year’s tax liability based on your habits.

- Voice-Activated Tax Help: Ask your AI assistant about deductions hands-free.

- Blockchain + AI Integration: Safer, more transparent tax record storage.

- Real-Time IRS Sync: Instant updates on refunds, tax law changes, and filing status.

Conclusion

AI is no longer just a buzzword – it’s a powerful tool that can help you save money, reduce stress, and lower your tax burden. Whether you are an employee filing a simple return or a business owner managing complex compliance requirements, there is an AI-powered tax solution for you.

Take the first step today: explore the tools we listed above, connect your financial data, and let AI do the heavy lifting this tax season. Smarter tax planning means more money in your pocket.

FAQ

Q1: What are the best AI tools to lower my tax burden?

TurboTax, H&R Block AI Tax Pro, Keeper Tax, FlyFin, and Avalara are among the best options in 2025.

Q2: Can AI really save me money on taxes?

Yes. AI scans for deductions and credits that you might otherwise miss, which can significantly reduce your tax bill.

Q3: Are AI tax tools secure?

Most platforms use bank-level encryption and comply with IRS e-filing regulations, making them safe to use.

Q4: Can freelancers and gig workers use AI tax tools?

Absolutely. Tools like Keeper Tax and FlyFin are designed specifically for freelancers and self-employed professionals.

Q5: How much do AI tax tools cost?

Pricing ranges from free plans for simple returns to around $10-$20/month for freelancer-focused tools, with business solutions like Avalara offering custom pricing.