Managing money used to mean spreadsheets, receipts, and constant manual tracking. For most people, that system never really worked. Expenses slipped through the cracks, subscriptions were forgotten, and budgets were abandoned within weeks.

In 2026, that entire process is changing.

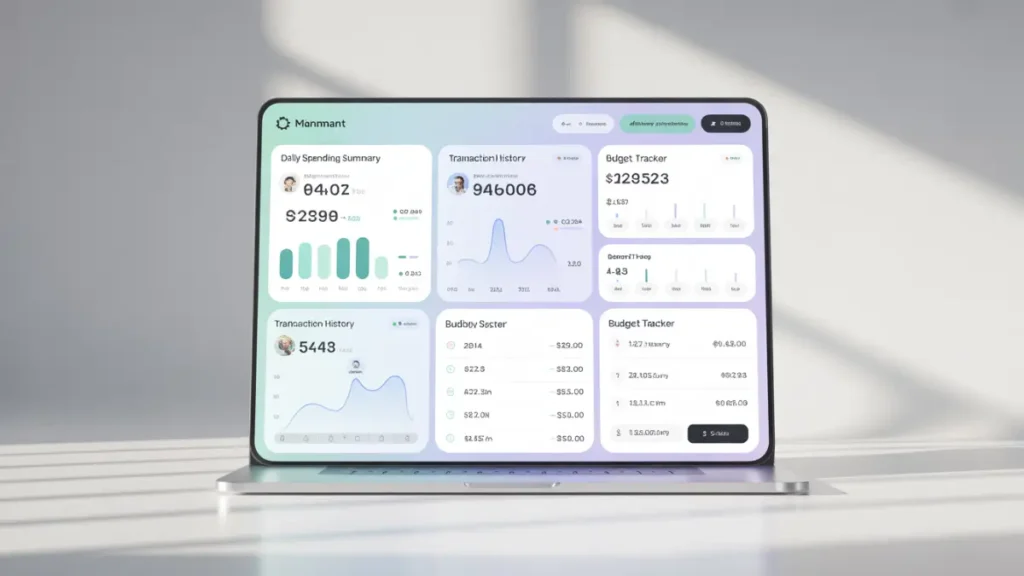

Artificial Intelligence is now capable of tracking every dollar you spend automatically, analyzing your financial behavior, and actively helping you save more money without changing your lifestyle. Instead of guessing where your money goes, AI shows you exactly what is happening in real time — and more importantly, what to do about it.

This guide explains how AI money tracking works, how it saves you money, and which tools are leading the way.

What Is AI Money Tracking?

AI money tracking is the use of artificial intelligence to automatically monitor, categorize, and analyze your financial transactions across all accounts.

Unlike traditional budgeting apps that rely on manual input, AI connects directly to your:

- Bank accounts

- Credit cards

- Debit cards

- Investment platforms

- Subscription services

Once connected, the AI system:

- Tracks every transaction in real time

- Categorizes spending automatically

- Detects patterns in your behavior

- Predicts future expenses

- Recommends smarter financial actions

In simple terms, AI becomes your personal financial assistant that works 24/7.

How AI Tracks Every Dollar (Step by Step)

Most people imagine AI as something complex, but the process is surprisingly simple.

Step 1: Secure Account Linking

You connect your financial accounts using encrypted APIs (the same technology banks use). No passwords are stored.

Step 2: Automatic Transaction Tracking

Every time you spend money, the AI logs:

- Amount

- Merchant

- Category

- Payment method

- Time and frequency

Step 3: Smart Categorization

AI classifies spending into categories like:

- Groceries

- Rent

- Dining

- Transport

- Subscriptions

- Entertainment

Over time, it learns your habits and improves accuracy.

Step 4: Pattern Recognition

AI identifies trends such as:

- Overspending days

- Unnecessary recurring expenses

- Emotional spending

- Seasonal spending spikes

Step 5: Predictive Analysis

Advanced AI models forecast:

- End-of-month balances

- Upcoming bills

- Budget shortfalls

- Savings potential

This is where AI becomes powerful — it doesn’t just track the past, it predicts the future.

How AI Actually Saves You Money

Tracking alone doesn’t save money. Action does.

AI saves money through behavioral intelligence.

1. Eliminates Hidden Spending

Most users discover:

- Forgotten subscriptions

- Duplicate services

- Small daily expenses adding up

AI highlights these instantly.

2. Prevents Overspending

AI sends alerts when:

- You’re close to budget limits

- Spending behavior changes

- Bills increase unexpectedly

This stops problems before they happen.

3. Automates Smarter Decisions

AI recommends:

- Lower-cost alternatives

- Subscription cancellations

- Bill negotiation tools

- Optimized saving amounts

4. Builds Passive Savings

Many AI tools automatically:

- Transfer spare change to savings

- Move unused money to high-yield accounts

- Increase savings when income rises

The result: money is saved without effort.

Best AI Apps That Track Your Money in 2026

Here are some of the most effective AI finance tools used by Americans today.

| App | AI Features | Best For | Price |

| Mint | Auto tracking, insights | Beginners | Free |

| Copilot Money | Deep analytics | iOS users | Paid |

| Rocket Money | Bill cutting AI | Expense reduction | Free/Paid |

| YNAB | Predictive budgeting | Serious planners | Paid |

| Cleo | AI financial assistant | Young users | Free/Paid |

Each of these uses machine learning to improve results over time.

Real-Life Example: AI Budget in Action

Let’s look at a realistic scenario.

Sarah earns $4,500 per month. She feels broke every month but doesn’t know why.

After connecting AI budgeting software:

AI discovered:

- $189/month in unused subscriptions

- $312/month on food delivery

- $95/month bank fees

- $220/month impulse Amazon spending

Total waste: $816/month

The AI system recommended:

- Cancel 5 subscriptions

- Set dining budget alerts

- Switch to no-fee checking

- Weekly spending caps

Within 60 days, Sarah saved over $1,400 without increasing income.

This is how AI creates real financial change.

AI vs Traditional Budgeting

| Feature | Traditional Budgeting | AI Budgeting |

| Manual input | Yes | No |

| Real-time tracking | No | Yes |

| Predictive analysis | No | Yes |

| Behavior insights | No | Yes |

| Automation | Low | High |

| Accuracy | Medium | Very high |

Traditional budgeting fails because it relies on discipline.

AI works because it relies on data + automation.

Is AI Money Tracking Safe?

Security is the #1 concern for most users.

Modern AI finance apps use:

- Bank-level encryption

- Read-only access

- OAuth authentication

- No password storage

- Zero ability to move money

They cannot:

- Withdraw funds

- Make purchases

- Transfer money

They only analyze data.

In many cases, these platforms are more secure than spreadsheets or notebooks.

Who Should Use AI Budgeting Tools?

AI money tracking is ideal for:

- People living paycheck to paycheck

- Freelancers and gig workers

- Families managing shared finances

- Young professionals

- Anyone saving for goals

- Anyone tired of manual budgeting

If you use a bank account, AI can help you.

How to Start Using AI Today

Getting started takes less than 10 minutes.

Step 1: Choose an AI finance app

Mint, Copilot, Rocket Money, or YNAB.

Step 2: Connect accounts

Secure login through your bank.

Step 3: Set financial goals

Savings targets, debt reduction, monthly limits.

Step 4: Let AI analyze

Wait 7–14 days for meaningful insights.

Step 5: Follow recommendations

This is where real savings happen.

Common Mistakes People Make

Even with AI, users fail when:

- They ignore alerts

- They never review reports

- They don’t act on recommendations

- They treat it like entertainment

AI only works when you engage with the insights.

The Psychology Behind Why AI Works

Humans are emotional spenders.

AI is not.

AI:

- Removes emotional bias

- Uses objective data

- Shows uncomfortable truths

- Forces awareness

This creates behavioral change, which is the foundation of saving money.

Future of AI Money Management

By 2027–2028, AI systems will:

- Negotiate bills automatically

- Predict financial stress

- Optimize taxes

- Create personalized investment plans

- Act as full financial advisors

We are moving toward fully automated personal finance.

Frequently Asked Questions (FAQ)

How does AI track spending?

AI connects to your financial accounts and analyzes transaction data in real time using machine learning models.

Can AI really save money?

Yes. Most users save between 10%–30% of monthly income by eliminating waste and optimizing spending.

Are AI budgeting apps safe?

Yes. They use bank-level security and read-only access.

What is the best AI finance app?

Mint for beginners, Copilot for analytics, Rocket Money for bills.

Do I need technical skills?

No. Most apps are beginner-friendly.

Final Thoughts: Why AI Is the Future of Money

AI doesn’t just track money.

It changes how you think about money.

Instead of:

- Guessing where your money went

- Feeling broke without answers

- Manually managing budgets

You get:

- Full financial clarity

- Automatic insights

- Predictive savings

- Real control

In 2026, the people who win financially aren’t those who earn more — they are the ones who use AI to manage what they already have.

And that’s exactly how AI tracks every dollar and saves you more.

Written by Behzad Aslam, who researches AI tools for personal finance…