Best Smart Money Tools for Americans in 2026

AI apps that cut monthly expenses are helping millions of Americans in 2026 save up to 30% of their monthly income. Instead of tracking every dollar manually, these smart money tools automatically cancel unused subscriptions, lower bills, and optimize everyday spending without changing your lifestyle.

If your rent, groceries, insurance, and streaming services feel more expensive every year, you’re not alone. But here’s the good news: AI apps can now cut monthly expenses by up to 30%, and many of them work automatically in the background.

In this guide, you’ll discover the best AI apps for saving money in the USA, how they work, and how Americans are using them to keep more of their income every month.

How AI Apps Reduce Your Monthly Expenses

Traditional budgeting apps require manual tracking. You enter expenses, set categories, and hope you stick to the plan. AI apps work differently.

They use:

- Machine learning

- Bank transaction analysis

- Behavioral data

- Predictive algorithms

to understand how you spend money and where you are wasting it.

Instead of telling you what happened last month, AI predicts what you will spend next month and takes action to lower it.

These apps:

Learn more: https://behzadaslam.com/about-behzad-aslam/

- Identify hidden fees

- Cancel unused subscriptions

- Find cheaper alternatives

- Optimize your bills

- Automate savings

That’s how real people are now cutting $300 to $800 per month without changing their lifestyle.

How AI Apps That Cut Monthly Expenses Work

Inflation, housing costs, and subscription overload have made manual budgeting nearly impossible. The average American now has more than 12 active subscriptions, many of which are unused.

AI apps solve this by:

- Scanning bank statements

- Finding patterns humans miss

- Making automatic money decisions

Instead of reacting to money problems, you prevent them.

That’s the real power of financial AI.

Best AI Apps That Cut Monthly Expenses in the USA

These are the most effective AI-powered money-saving apps Americans are using in 2026.

1. Rocket Money (Formerly Truebill)

Rocket Money uses AI to analyze your spending and find recurring charges. It automatically:

- Cancels unwanted subscriptions

- Tracks bills

- Monitors spending habits

Most users save between $50 and $300 per month just from subscription cleanup.

Its AI also alerts you when bills increase so you can take action instantly.

2. Cleo AI

Cleo is an AI financial assistant that talks to you like a human. It connects to your bank and:

- Tracks your spending

- Predicts upcoming expenses

- Tells you when you are overspending

What makes Cleo powerful is its behavioral AI. It changes your spending habits without you even realizing it.

Many users report saving 10–20% of their income within three months.

3. Trim

Trim is one of the most powerful AI tools for cutting bills. It:

- Negotiates cable, internet, and phone bills

- Cancels subscriptions

- Finds better insurance deals

Trim uses AI to talk directly with companies on your behalf. People often save $20–$50 per bill, which can add up to hundreds per year.

4. Monarch Money

Monarch uses AI to build a personalized budget for you. It:

- Learns how you spend

- Adjusts categories

- Predicts future cash flow

This prevents overdrafts, late fees, and surprise expenses — which are some of the biggest money drains for Americans.

5. YNAB (You Need A Budget) with AI Insights

- Predict overspending

- Recommend savings

- Adjust budgets automatically

It helps users build financial discipline while AI handles the hard calculations.

How These Apps Help You Save Up to 30%

Let’s break it down.

Here’s where most people lose money every month:

| Expense Type | Average Monthly Waste |

| Unused subscriptions | $50–$100 |

| Overpriced internet & cable | $30–$80 |

| Banking & late fees | $25–$60 |

| Poor budgeting | $100–$300 |

| High insurance rates | $50–$150 |

AI apps target every one of these.

When combined, the average American can easily save 20–30% of their monthly expenses using AI tools.

For a household spending $4,000 per month, that’s:

$800 to $1,200 in monthly savings

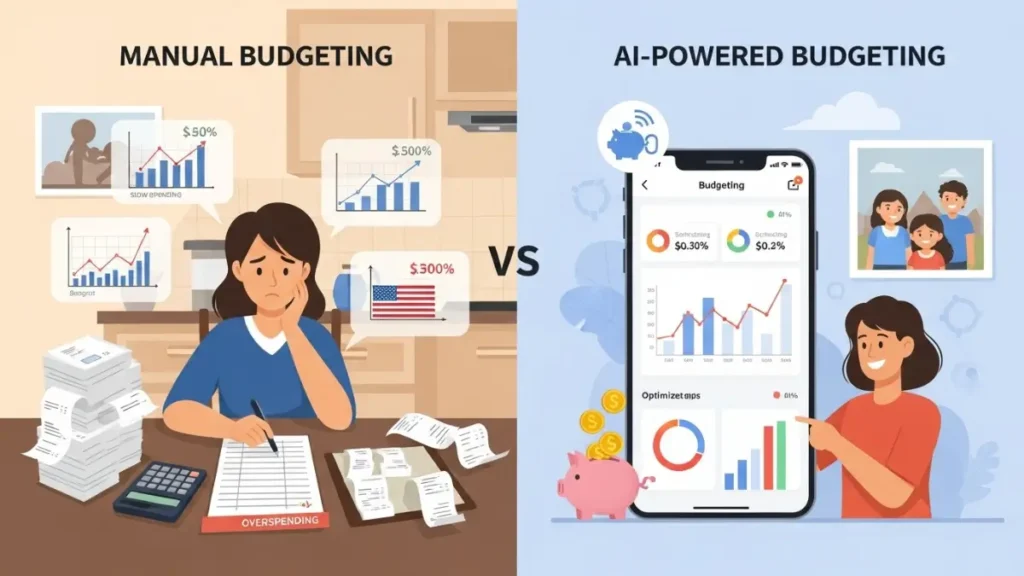

AI vs Traditional Budgeting

| Feature | Traditional Budgeting | AI Budgeting |

| Manual tracking | Yes | No |

| Predicts future spending | No | Yes |

| Cancels subscriptions | No | Yes |

| Negotiates bills | No | Yes |

| Automates savings | No | Yes |

| Learns behavior | No | Yes |

Traditional budgeting shows you what went wrong.

AI fixes the problem before it happens.

How to Start Using AI to Cut Your Expenses

Getting started is simple:

Step 1

Choose one AI finance app like Rocket Money or Cleo.

Step 2

Connect your bank account securely.

Step 3

Let the AI analyze your spending.

Step 4

Review the recommendations.

Step 5

Enable auto-savings and bill tracking.

Within a few weeks, you will start seeing lower expenses and more money staying in your account.

Is It Safe to Use AI Finance Apps?

Yes. Reputable AI money apps use:

- Bank-level encryption

- Read-only access

- Secure APIs

They cannot move your money without permission. They only analyze your data to help you save.

Most AI apps that cut monthly expenses use read-only bank access and encrypted APIs, making them safe for everyday use by Americans in 2026.

Millions of Americans already use these apps every day.

Pros and Cons of AI Money Apps

Pros

- Automatically saves money

- Finds waste you miss

- Reduces financial stress

- Works 24/7

- Improves habits

Cons

- Some charge small fees

- Requires bank connection

- You must review recommendations

The savings usually far exceed the cost.

Real Example: How AI Cut a Family’s Expenses by 30%

A California family earning $6,000 per month used:

- Rocket Money

- Trim

- Monarch

Within 60 days they:

- Canceled $180 in subscriptions

- Reduced internet and phone bills by $95

- Eliminated overdraft fees

- Optimized grocery spending

Total savings: $780 per month

That’s over $9,000 per year — without lifestyle changes.

Unlike traditional budgeting tools, AI apps that cut monthly expenses work in the background, constantly analyzing spending patterns and taking action to reduce waste automatically.

Why 2026 Is the Best Time to Use AI for Money

AI in finance has improved dramatically. These tools now:

- Understand human behavior

- Predict spending

- Automatically optimize budgets

This is no longer experimental technology. It is now a financial advantage.

Those who use AI keep more money.

Those who don’t continue to lose it.

Frequently Asked Questions

Do AI apps really save money?

Yes. They identify waste, optimize bills, and automate smart decisions, which leads to real savings.

Are AI budgeting apps free?

Many have free versions. Premium plans usually cost $5–$10 per month, but users often save hundreds.

Is my bank data safe?

Yes. These apps use encrypted connections and cannot access your money without permission.

Which AI app saves the most money?

Rocket Money and Trim are best for cutting bills, while Cleo and Monarch are best for budgeting.

Can I use more than one AI app?

Yes. Many people combine them for maximum savings.

Final Thoughts

AI apps that cut monthly expenses are no longer optional tools — they are becoming a smart financial advantage for Americans who want to save more without changing their lifestyle.

AI apps that cut monthly expenses by 30% are real, powerful, and already changing how Americans manage money.

If you are tired of feeling broke despite earning more, now is the time to let artificial intelligence do the work for you.

The smartest money decision you can make today may simply be letting AI manage your finances.