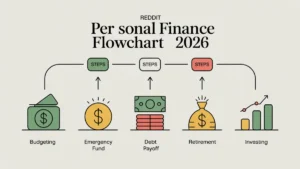

The Reddit Personal Finance Flowchart 2026 is designed to help people make smarter money decisions step by step.Personal finance advice is everywhere, yet many people still feel stuck when deciding what to do with their money. Should you pay off debt first? Build savings? Start investing? In 2026, this confusion has not gone away—if anything, rising living costs and changing interest rates have made it worse. That is why the Reddit Personal Finance Flowchart 2026 continues to stand out as one of the most trusted money roadmaps available online.

Created and refined by the r/personalfinance community, this flowchart offers a clear order of operations for managing money. Instead of chasing trends or shortcuts, it focuses on fundamentals that work across different income levels and life stages. In this updated guide, you will learn how the Reddit personal finance flowchart works in 2026, what has changed, and how to apply it realistically in the United States.

What Is the Reddit Personal Finance Flowchart 2026?

The Reddit personal finance flowchart is a decision-making roadmap that helps people answer one essential question:

What should I do with my money next?

It breaks personal finance into logical steps, starting with basic stability and moving toward long-term wealth building. The flowchart was developed by everyday people sharing real financial experiences, mistakes, and successes inside the r/personalfinance subreddit.

Rather than promoting complex strategies, the flowchart emphasizes:

- Living within your means

- Protecting yourself from emergencies

- Eliminating costly debt

- Using retirement accounts effectively

- Investing with a long-term mindset

Its simplicity is exactly why it works.What Is the Reddit Personal Finance Flowchart 2026?

What’s New in the Reddit Personal Finance Flowchart for 2026?

This update makes the Reddit Personal Finance Flowchart 2026 more practical for today’s economic conditions.

While the core principles remain unchanged, the 2026 version of the Reddit personal finance flowchart reflects modern financial realities:

- Higher interest rates make debt payoff more impactful

- High-yield savings accounts are more competitive

- Retirement contribution limits continue to rise

- Inflation awareness plays a bigger role in budgeting

- Financial flexibility is prioritized over aggressive risk

The flowchart has evolved to emphasize stability and adaptability, recognizing that economic conditions can shift quickly.

Why the r/PersonalFinance Flowchart Still Works in 2026

Many financial plans fail because they assume perfect conditions. The Reddit personal finance flowchart works because it is built for real life. It accounts for unexpected expenses, income changes, and human behavior.

In 2026, it remains effective because it:

- Avoids get-rich-quick thinking

- Encourages disciplined progress

- Reduces financial stress before chasing growth

- Adapts to different income levels

Instead of asking how fast you can build wealth, it asks how well you can sustain financial health.

The Complete Step-by-Step Breakdown (2026 Edition)

Step 1: Understand Your Income and Spending

Each step in the Reddit Personal Finance Flowchart 2026 builds long-term financial stability.

- How much you earn

- Where your money goes each month

- Whether you are spending more than you earn

In 2026, this step is more important than ever. Subscription services, variable expenses, and rising costs can quietly drain income. The goal is not perfection, but awareness.

Step 2: Build a Starter Emergency Fund

The next step is creating a small emergency fund, usually between $1,000 and one month of essential expenses.

This starter fund exists to:

- Prevent new debt

- Handle minor emergencies

- Reduce financial anxiety

Without this cushion, even a small setback can undo progress.

Step 3: Eliminate High-Interest Debt

High-interest debt is one of the biggest obstacles to financial freedom. In 2026, with interest rates still elevated, this step carries even more weight.

The flowchart prioritizes paying off:

- Credit card balances

- High-interest personal loans

- Payday or short-term loans

This example shows how the Reddit Personal Finance Flowchart 2026 works for a typical U.S. household.

Step 4: Capture Employer Retirement Matches

If your employer offers a 401(k) match, the flowchart recommends contributing enough to receive the full match before moving on.

This step matters because:

- Employer matches are part of your compensation

- Skipping them is leaving money behind

- The return is immediate and risk-free

Even while paying off debt, capturing a match can be a smart balance.

Step 5: Build a Full Emergency Fund

Once high-interest debt is under control, the flowchart shifts back to savings. A full emergency fund typically covers three to six months of essential expenses.

In 2026, many people aim for the higher end due to:

- Job market uncertainty

- Higher cost of living

- Increased medical expenses

This fund should remain liquid and easily accessible.

Step 6: Increase Retirement Investing

Only after establishing financial stability does the flowchart encourage more aggressive investing.

Common priorities include:

- Increasing 401(k) contributions

- Funding a Roth or Traditional IRA

- Choosing low-cost, diversified funds

The emphasis is on consistency, not market timing.What Is the Reddit Personal Finance Flowchart 2026?

Step 7: Invest for Long-Term Goals and Wealth

At the top of the flowchart are long-term wealth-building strategies. These may include:

- Taxable investment accounts

- Real estate investments

- College savings plans

- Early retirement planning

At this stage, your finances are strong enough to handle calculated risk.

Text-Based Explanation of the Flowchart

Think of the Reddit personal finance flowchart as a pyramid:

- The base is budgeting and emergency savings

- The middle is debt elimination and retirement planning

- The top is investing and wealth growth

Skipping the base weakens everything above it.

How the Reddit Personal Finance Flowchart 2026 Works

Imagine a U.S. household earning $75,000 per year in 2026:

- They track expenses and adjust spending

- Save $2,000 as a starter emergency fund

- Pay off $6,000 in credit card debt

- Contribute enough to receive a full 401(k) match

- Build six months of savings

- Increase retirement contributions steadily

Following the flowchart gives them structure and confidence without rushing decisions.

Key Financial Factors to Consider in 2026

The 2026 financial environment makes the flowchart especially relevant:

- Inflation requires smarter budgeting

- Interest rates reward savings discipline

- Debt is more expensive to carry

- Long-term investing still favors patience

The flowchart helps balance caution with growth.

Common Mistakes People Make in 2026

Even with clear guidance, people often struggle by:

- Investing too early while carrying debt

- Ignoring emergency savings

- Overreacting to market headlines

- Comparing progress to others

The flowchart works best when followed patiently and consistently.What Is the Reddit Personal Finance Flowchart 2026?

Why the Reddit Personal Finance Flowchart 2026 Is Still Effective

Yes. In fact, beginners may benefit the most. The flowchart removes guesswork and provides a clear starting point.

It is especially useful for:

- Young professionals

- Families rebuilding finances

- People overwhelmed by conflicting advice

Advanced investors may customize it, but the core order remains solid.

Best Alternatives to the Reddit Flowchart in 2026

Other frameworks include:

- The Financial Order of Operations

- Dave Ramsey’s Baby Steps

- The Bogleheads approach

However, the Reddit flowchart remains popular because it balances discipline with flexibility.

Frequently Asked Questions

Is the Reddit personal finance flowchart updated for 2026?

Yes. The community regularly reviews and adapts it to reflect current economic conditions.The Reddit Personal Finance Flowchart 2026 is updated to reflect modern budgeting, saving, and investing needs.

What changed in the 2026 version?

Greater emphasis on emergency savings, higher interest rate awareness, and financial flexibility.

Can beginners follow the 2026 flowchart?

Absolutely. It is designed to be beginner-friendly.

Should I invest before paying off all debt?

The flowchart allows limited investing, such as employer matches, while prioritizing high-interest debt payoff.

Is this flowchart only for the United States?

It is primarily designed for the U.S. system but can be adapted elsewhere.

Final Thoughts

The Reddit Personal Finance Flowchart 2026 is not about chasing trends or maximizing returns overnight. It is about building a stable financial life step by step. Its power lies in helping people make better decisions consistently, even during uncertain times.

If you are unsure what to do next with your money in 2026, this flowchart offers clarity without pressure. Follow it patiently, adapt it to your situation, and focus on progress—not perfection.

By following the Reddit Personal Finance Flowchart 2026, you can make confident and informed money decisions.