Starting your credit journey can feel confusing, especially when you’re faced with two unfamiliar options: secured and unsecured credit cards. For beginners in the United States especially those with no credit history or a low credit score choosing the right type of credit card is one of the most important financial decisions you’ll make early on.

Both secured and unsecured credit cards can help you build credit, but they work very differently and serve different types of users. Understanding how each option functions, along with their pros, cons, and long-term impact on your financial health, can save you from costly mistakes.

This guide breaks down everything beginners need to know about secured vs unsecured credit cards, helping you choose the option that best fits your situation.

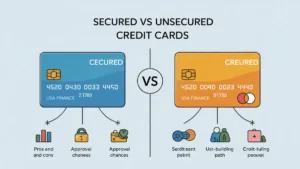

Secured vs Unsecured Credit Cards: Key Differences for Beginners

A secured credit card is designed for people with little to no credit history or poor credit. Unlike traditional credit cards, secured cards require a refundable security deposit before you can start using the card.

How Secured Credit Cards Work

When you open a secured credit card, you provide a cash deposit—typically between $200 and $500. This deposit usually becomes your credit limit. For example, if you deposit $300, your credit limit will often be $300.

The deposit acts as collateral for the credit card issuer. If you fail to pay your bill, the issuer can use your deposit to cover the balance. This reduced risk makes secured cards much easier to qualify for.

Who Secured Credit Cards Are Best For

- Beginners with no credit history

- People recovering from past credit mistakes

- Students or young adults new to credit

- Immigrants building credit in the U.S.

Many users start with secured cards and later switch to unsecured credit cards. Choosing between secured vs unsecured credit cards depends on your credit history.

What Is an Unsecured Credit Card?

An unsecured credit card is what most people think of as a traditional credit card. It does not require a security deposit and offers a credit limit based on your creditworthiness.

How Unsecured Credit Cards Work

With an unsecured card, the issuer evaluates your credit score, income, and credit history before approving your application. Your credit limit, interest rate, and fees are determined by how financially reliable you appear.

Because there is no collateral, unsecured cards are riskier for lenders. As a result, approval standards are stricter, especially for beginners.

Who Unsecured Credit Cards Are Best For

- People with established credit history

- Borrowers with fair to good credit scores

- Individuals with steady income and low debt

Some unsecured cards are marketed to beginners, but they often come with lower credit limits and higher interest rates.secured vs unsecured credit cards

Key Differences Between Secured and Unsecured Credit Cards

Understanding the core differences between secured and unsecured credit cards can make your decision much easier.

| Feature | Secured Credit Card | Unsecured Credit Card |

| Security Deposit | Required | Not required |

| Approval Odds | High | Lower for beginners |

| Credit Limit | Usually equals deposit | Based on credit profile |

| Interest Rates | Often higher | Can be lower |

| Credit Building | Yes | Yes |

| Best For | No or bad credit | Fair to good credit |

For most beginners, approval odds are the deciding factor. Secured cards are generally far easier to qualify for.secured vs unsecured credit cards

How to Choose Between Secured vs Unsecured Credit Cards

Pros of Secured Credit Cards

Easy approval

Secured cards are one of the easiest ways to get approved for credit, even with no credit history.

Credit-building benefits

Most secured cards report activity to all three major credit bureaus, helping you build a positive credit history.

Spending control

Lower credit limits can help beginners avoid overspending and falling into debt.

Potential upgrade path

Many secured cards allow you to graduate to an unsecured card after consistent on-time payments.

Cons of Secured Credit Cards

Upfront deposit required

You must tie up cash to open the account, which can be difficult for some beginners.

Lower credit limits

Your spending power is limited unless you increase your deposit.

Fewer rewards

Most secured cards do not offer rewards or cash back.

When comparing secured vs unsecured credit cards, beginners should consider approval odds and credit limits.secured vs unsecured credit cards

Pros and Cons of Unsecured Credit Cards

Pros of Unsecured Credit Cards

No deposit required

You don’t need upfront cash to open the account.

Higher credit limits

Unsecured cards may offer more spending flexibility.

Rewards and benefits

Many unsecured cards offer cash back, travel rewards, and other perks.

Cons of Unsecured Credit Cards

Harder to qualify for beginners

Approval often requires existing credit history.

Higher interest rates for new users

Beginner unsecured cards frequently carry high APRs.

Higher risk of debt

Larger credit limits can tempt new users into overspending.

Which Credit Card Is Better for Beginners?

The best credit card for beginners depends on your current financial situation and credit background.

If You Have No Credit History

A secured credit card is usually the better choice. It offers easy approval and a safer way to build credit without risking large amounts of debt.secured vs unsecured credit cards

If You Have Bad or Damaged Credit

Secured cards provide a reliable path to rebuilding credit. Unsecured cards may either deny your application or offer unfavorable terms.

If You Have Fair Credit and Stable Income

You may qualify for an entry-level unsecured credit card. However, compare fees and interest rates carefully before applying.

If You Are a Student or Young Adult

Student unsecured cards can be an option, but secured cards remain safer if your income is limited or inconsistent.

How Secured Credit Cards Help Build Credit

Credit cards affect your credit score through several key factors.secured vs unsecured credit cards

Payment History

Paying your bill on time every month is the most important factor. Secured cards help beginners develop this habit early.

Credit Utilization

Keeping your balance low compared to your credit limit improves your score. With secured cards, beginners often manage utilization more easily.

Length of Credit History

The longer you keep an account open, the better. Secured cards can serve as a strong foundation for long-term credit building.

With consistent use, many cardholders see measurable improvements in their credit score within six to twelve months.secured vs unsecured credit cards

Can You Switch From a Secured to an Unsecured Card?

Yes. Many credit card issuers allow secured cardholders to upgrade to an unsecured card after demonstrating responsible use.

How the Upgrade Process Works

- Make all payments on time

- Keep balances low

- Maintain the account for six to twelve months

Once approved, your security deposit is refunded, and your account may continue as an unsecured card.secured vs unsecured credit cards

Common Beginner Credit Card Mistakes to Avoid

Even the right credit card can hurt your finances if used incorrectly.

Missing Payments

Late payments damage your credit score and may result in fees or higher interest rates.

Maxing Out Your Card

Using too much of your available credit increases your utilization ratio and lowers your score.

Applying for Too Many Cards

Multiple applications in a short time can hurt your credit and reduce approval chances.

Ignoring Fees and APR

Always read the fine print to avoid unnecessary costs.

Secured vs Unsecured Cards: Real-Life Example

Imagine two beginners starting their credit journey.secured vs unsecured credit cards

Beginner A opens a secured card with a $300 deposit. They use the card for small purchases and pay the balance in full every month.

Beginner B qualifies for an unsecured card with a $1,000 limit but often carries a balance and misses payments.

After one year, Beginner A likely has a stronger credit score, despite having a lower credit limit. Responsible behavior matters more than the type of card you choose.

Final Verdict: Which Card Should Beginners Choose?

For most beginners in the United States, a secured credit card is the safer and more reliable option. It offers easier approval, controlled spending, and a clear path to building credit.

Unsecured credit cards can be beneficial for beginners with fair credit and stable income, but they come with higher risks and stricter approval standards.

If your primary goal is to build credit responsibly, starting with a secured credit card is often the smartest move.secured vs unsecured credit cards

Frequently Asked Questions

Is a secured credit card good for beginners?

Yes. Secured credit cards are one of the best tools for beginners to build credit safely and effectively.

Do secured credit cards build credit the same way?

Yes. When reported to credit bureaus, secured cards build credit just like unsecured cards.

How long should beginners use a secured credit card?

Most beginners benefit from using a secured card for six to twelve months before upgrading.

Can beginners get an unsecured credit card?

Some beginners can, but approval depends on income and limited credit history.secured vs unsecured credit cards

Final Thought

Choosing between a secured and unsecured credit card is not about which option is better overall—it’s about which option is better for you right now. By starting responsibly and focusing on good habits, beginners can lay the foundation for strong credit and long-term financial stability.

For most beginners, the choice of secured vs unsecured credit cards is guided by current credit history and financial habits.